Bitcoin (BTC) has climbed 3% to $106,000 after weekend lows, but persistent resistance and shifting investor behavior raise questions about the sustainability of this recovery. At PRDT, we’re diving into the data to assess whether BTC is poised for a correction.

Key Takeaways

- Bitcoin faces strong resistance between $106,000 and $108,000, a zone that has historically capped rallies.

- Declining buyer momentum and rising profit-taking suggest a local top may be forming.

- A failure to break $106,000 could see BTC slide toward the $100,000 psychological level.

Bitcoin’s Momentum Fades Amid Profit-Taking

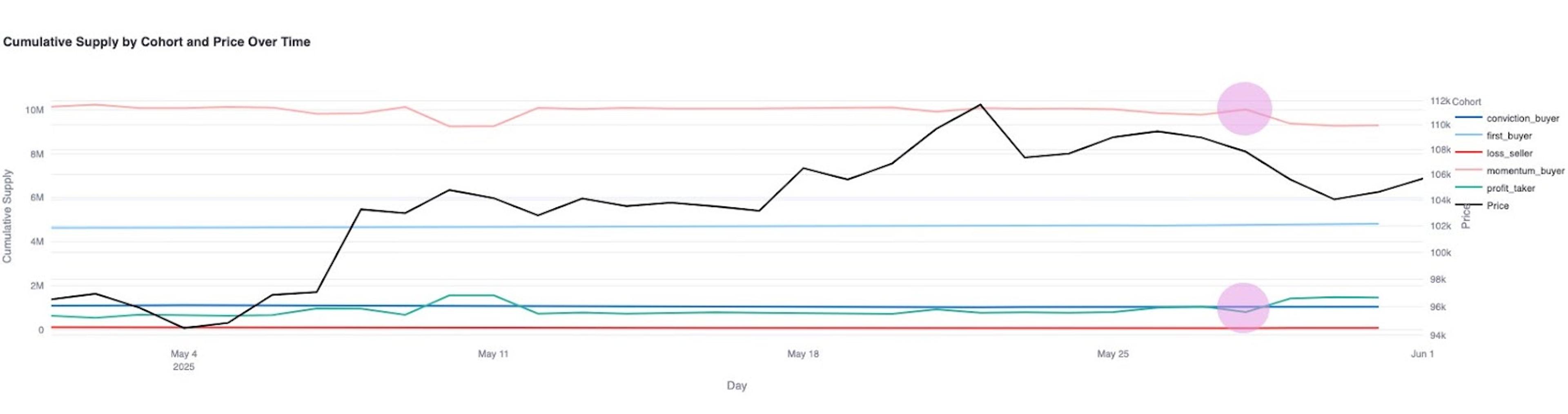

On-chain data highlights a shift in investor behavior that could signal trouble for Bitcoin’s near-term trajectory. According to Glassnode, buying momentum is waning, with the Relative Strength Index (RSI) for Momentum Buyers dropping to 20. Conversely, Profit Takers—investors cashing out gains—are on the rise, with their RSI climbing to 77.

Bitcoin cumulative supply by cohort over time. Source: Glassnode

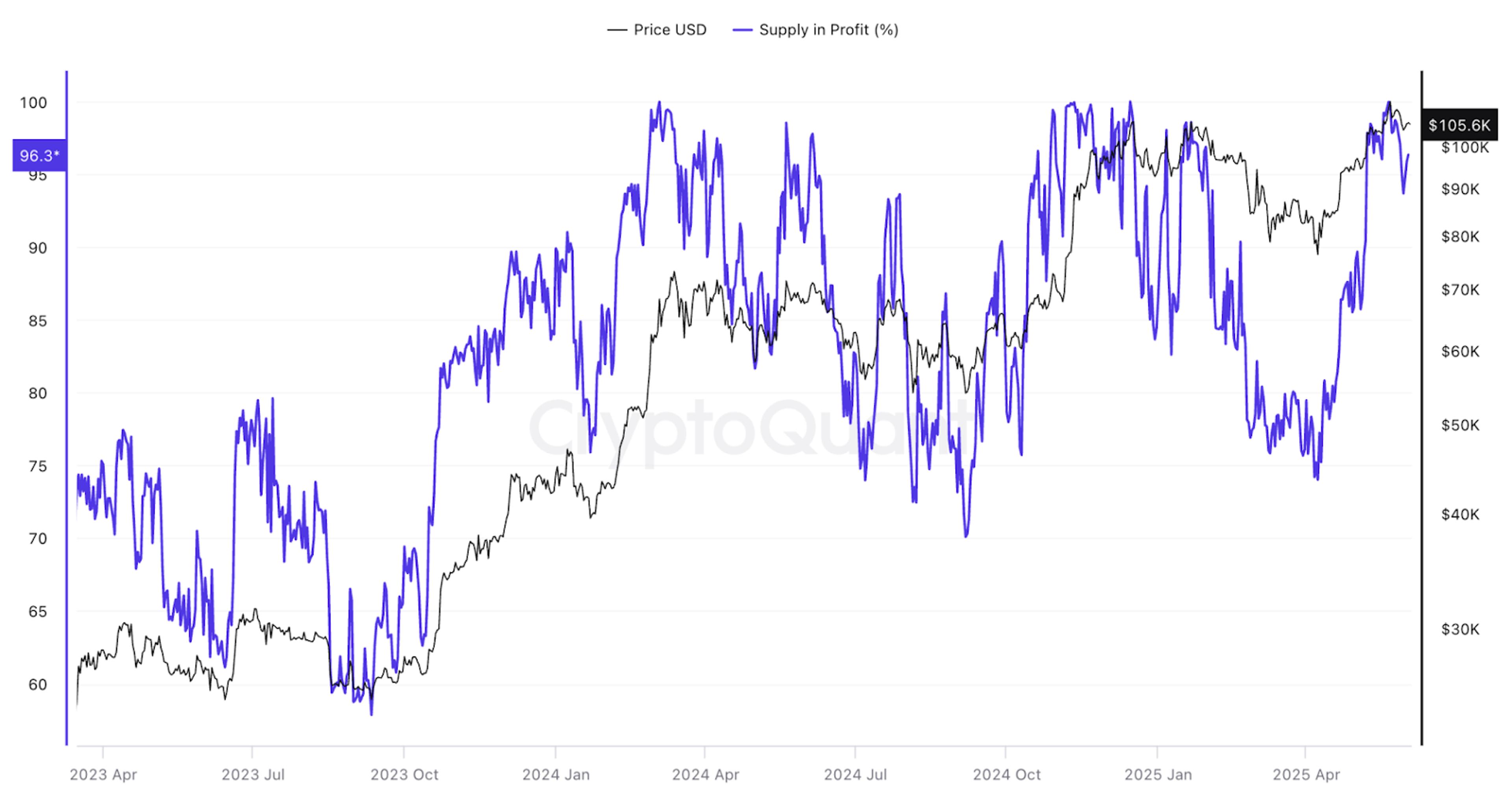

This divergence often precedes local tops, as traders prioritize locking in profits over accumulating positions. Additionally, CryptoQuant reports that 96% of Bitcoin’s supply is in profit at current levels ($105,000–$106,000). Historically, such high profitability signals an overheated market, increasing the likelihood of a pullback as holders sell to realize gains.

Bitcoin: Percentage of supply in profit/loss. Source: CryptoQuant

Technical Resistance Looms Large

From a technical perspective, Bitcoin’s recovery is stalling at a critical supply zone between $106,000 and $108,000, just shy of its all-time high of $109,000. This area has proven formidable, with a rejection in late January triggering a 27% drop to $78,000.

For bulls to regain control, a decisive daily close above $106,000 is essential. Without it, bearish pressure could intensify, potentially driving BTC toward $100,000, where liquidity pools and psychological support converge. Data shows a growing wall of ask orders above $106,000, underscoring the strength of this resistance.

BTC/USD Daily Chart

Source: TradingView

What’s Next for Bitcoin?

The interplay of fading momentum, high profitability, and technical resistance paints a cautious outlook for Bitcoin. At PRDT, our predictive models suggest that a failure to clear $106,000 in the coming days could trigger a deeper correction, with $100,000 as a key level to watch. Conversely, a breakout above $108,000 would signal renewed bullish momentum, potentially targeting new highs.

Stay ahead of the market with PRDT’s data-driven insights. Follow us for real-time updates and actionable analysis.

Disclaimer: Cryptocurrency markets are highly volatile. Always conduct your own research before making investment decisions.