A growing trade conflict and market volatility are fueling a surge in crypto derivatives activity across major US exchanges. As the financial world adjusts to renewed economic uncertainty, digital asset platforms are moving quickly to capture demand for risk management and speculative tools.

Since late 2024, platforms including Coinbase, Robinhood, Kraken, and CME Group have expanded their offerings of cryptocurrency derivatives, from Bitcoin futures to altcoin contracts like Solana and XRP. With trading volumes climbing and merger talks intensifying, the landscape is shifting fast.

Trade Policy Sparks a Derivatives Boom

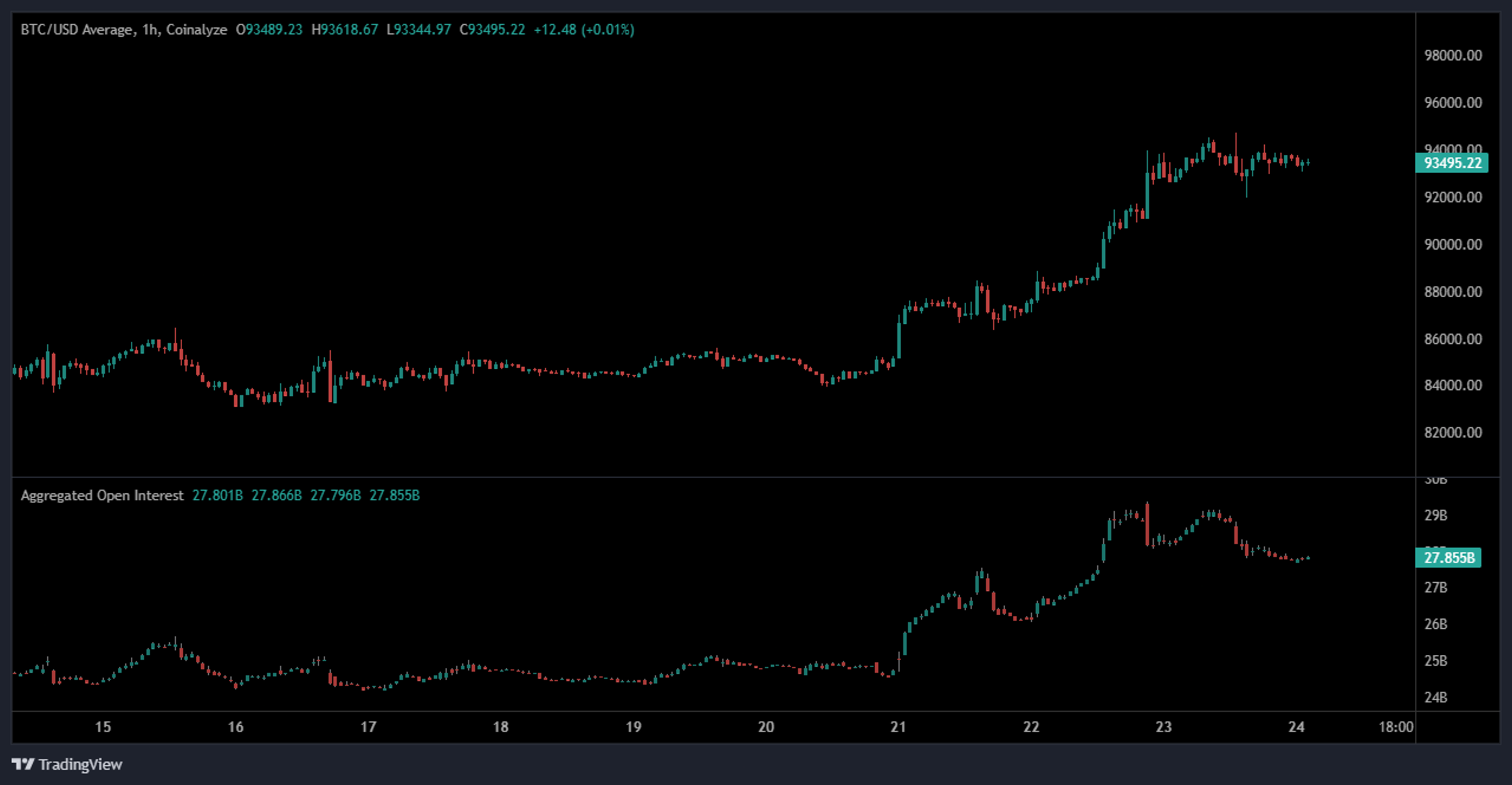

The catalyst? President Donald Trump’s sweeping tariff proposals, announced in early April 2025. Markets responded swiftly: equities dipped, volatility climbed, and derivatives volumes soared. According to Coinalyze, net open interest in Bitcoin futures jumped nearly 30% within weeks.

“Institutional and sophisticated retail traders are increasingly turning to crypto derivatives platforms to navigate macroeconomic risks,” said David Siemer, CEO of Wave Digital Assets. “Uncertainty has become a key driver of participation.”

This marks a continuation of momentum that began after Trump’s 2024 election win, which saw year-end derivatives volumes on some platforms rise over 10,000% year-over-year.

Net open interest in Bitcoin futures rose sharply in April. Source: Coinalyze

Strategic Moves from Major Players

As demand grows, US exchanges are acting fast to strengthen their competitive edge:

- Coinbase is reportedly in advanced talks to acquire Deribit, a leading crypto derivatives exchange, in a multibillion-dollar deal.

- Kraken acquired futures trading platform NinjaTrader for $1.5 billion in March.

- CME Group rolled out Solana futures, seeing over $12 billion in day-one trading volume.

- Robinhood entered the derivatives market with Bitcoin futures listings in February.

Kraken bought NinjaTrader in March. Source: Kraken

These moves signal a rapid escalation in the battle for derivatives market share, with traditional and crypto-native firms expanding offerings and exploring new assets.

Why Derivatives Matter Now

Futures and other derivatives allow traders to hedge, speculate, or manage risk with precision. In the face of geopolitical shocks and economic policy shifts, these instruments offer a way to stay agile.

“The recent wave of tariffs has transformed crypto derivatives exchanges into critical market infrastructure,” said Nic Roberts-Huntley, CEO of Blueprint Finance. “They’re no longer just speculative venues—they’ve become vital for navigating fragmented global conditions.”

As institutional interest deepens and macro uncertainty grows, derivatives are no longer a niche market—they’re defining the next chapter of crypto finance.

A Fast-Paced Future, Built for All

While traditional exchanges scale their offerings for institutional investors, a new wave of platforms is rising to meet the needs of everyday traders seeking speed, simplicity, and accessibility.

PRDT.Finance stands at the forefront of this shift, offering rapid-fire prediction markets where users can engage with both crypto and forex price movements in real time—without the complexity of traditional derivatives. With 1-minute rounds, intuitive design, and multi-chain access, PRDT empowers users to act on market momentum in seconds.

As volatility continues to shape the narrative, platforms like PRDT provide a sweet spot between informed speculation and accessible strategy. Whether you're hedging, testing the trend, or just exploring your edge—this is where agile trading finds its rhythm.