What You Need to Know About Bitcoin This Week

Bitcoin is facing one of its most turbulent weeks in recent memory — and it’s not just crypto feeling the heat. Global markets are flashing red as U.S. trade tariffs ripple across the financial world, dragging stocks and digital assets alike into stormy territory.

From technical breakdowns to investor panic, here's what’s driving the chaos — and how Bitcoin could respond.

A Bearish Breakdown Unfolds

Bitcoin’s recent slip below $75,000 has triggered alarm bells across the board. A bearish “death cross” has just completed on the daily chart — a historically ominous signal where the 50-day moving average dips below the 200-day.

Support levels are evaporating fast. The once-unthinkable return to $69,000 — a key price from the 2021 bull market — is now back on the radar.

Analysts are warning that this could be Bitcoin’s last chance to hold its macro uptrend. If support continues to break, we could be staring down even lower levels.

Markets on Edge Over Tariffs and Inflation

While inflation data (CPI and PPI) was expected to be the headline this week, U.S. trade tariffs have taken over the spotlight. With more measures scheduled to hit April 9, panic is setting in.

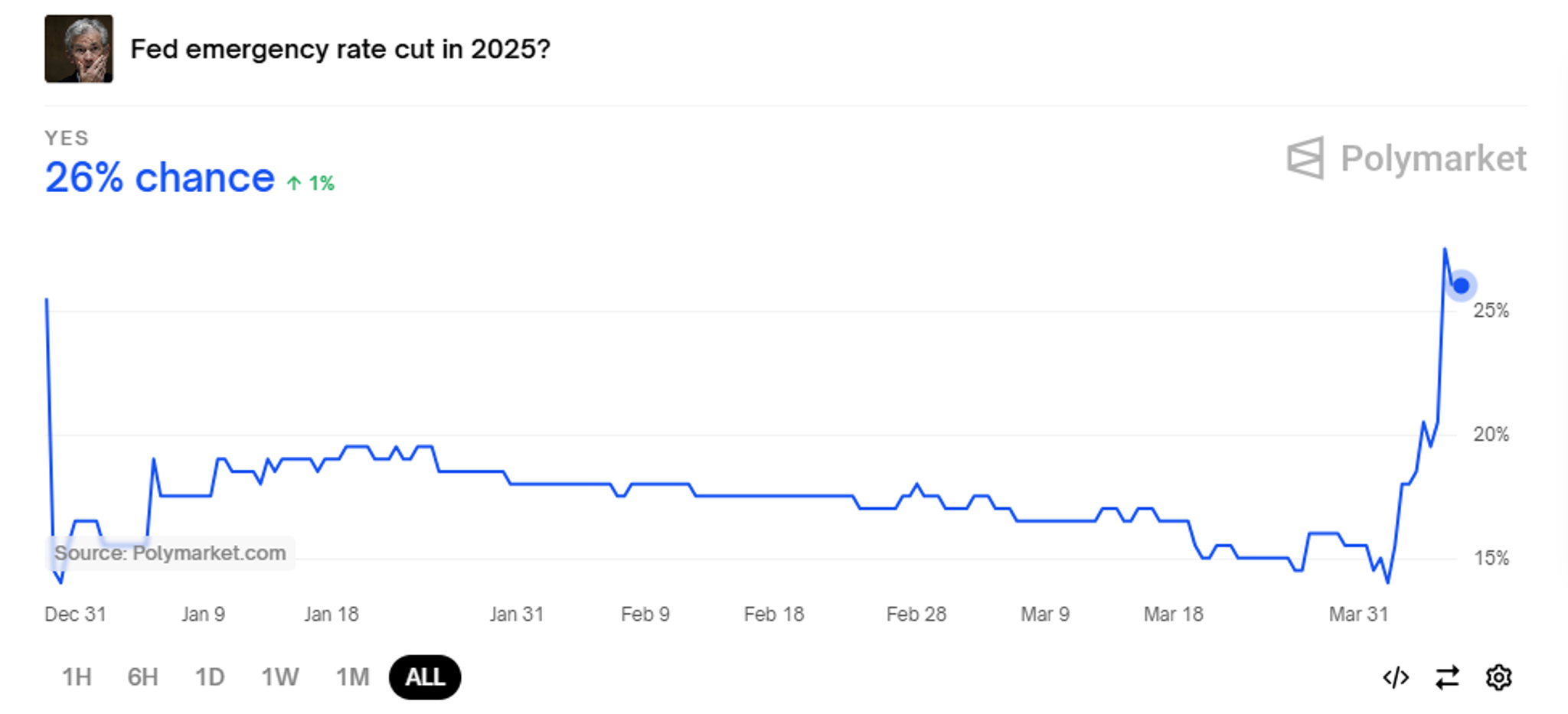

Talk of emergency rate cuts from the Fed is growing louder. Speculation is swirling across platforms like Polymarket, and interest rate trackers show a shift in expectations toward an earlier-than-expected cut in May.

Investors are bracing for impact — and preparing for a scenario where risk assets, from stocks to Bitcoin, face another wave of heavy selling.

Flashbacks to 1987 and 2020

Volatility is exploding, and market commentators are drawing eerie comparisons to Black Monday 1987 and the COVID crash of 2020.

In Asia, trading sessions kicked off the week with circuit breakers — the first since early pandemic days. Sentiment has plunged to crisis levels, with traders describing it as the most extreme panic since March 2020.

Some analysts warn Bitcoin could dip as low as $70K in the coming days unless a drastic policy shift, such as a surprise rate cut, reverses the tide.

Short-Term Holders Are Feeling the Pain

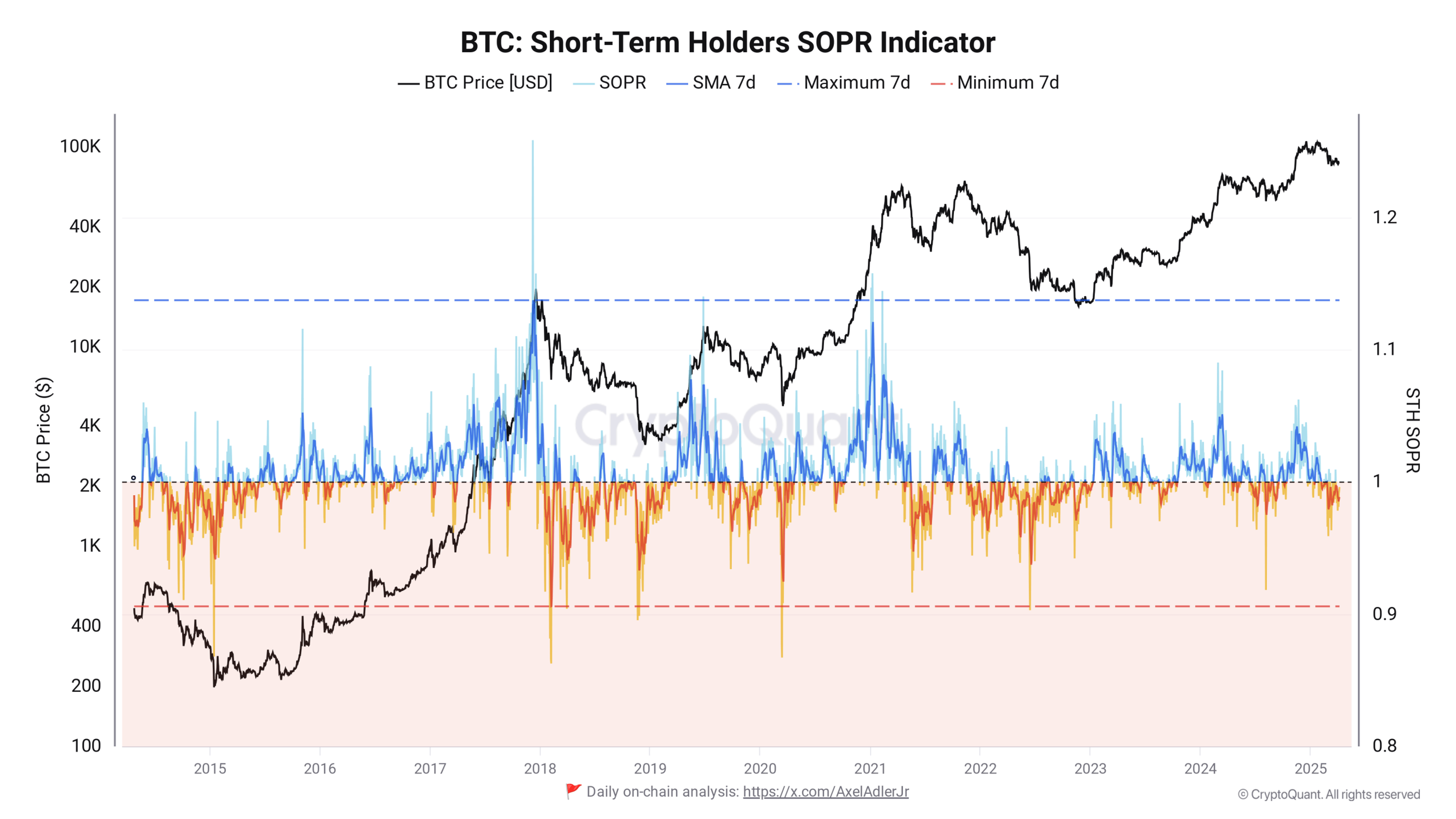

On-chain data confirms what many are fearing: short-term Bitcoin holders are deep in the red. The Spent Output Profit Ratio (SOPR) has dropped below breakeven, signaling widespread capitulation.

This group, typically more sensitive to price swings, is now selling at a loss — a familiar pattern that often precedes local bottoms, but also reinforces short-term downside pressure.

Bitcoin STH-SOPR chart. Source: CryptoQuant

Sentiment Hits Rock Bottom

Investor fear has reached historic lows. The traditional markets’ Fear & Greed Index just printed a 4 out of 100 — the lowest score ever recorded. Even the panic during COVID and the FTX collapse didn’t drag it down this far.

In crypto, the picture is only slightly better, with the Crypto Fear & Greed Index sitting at 23.

But where others see fear, some see opportunity. A handful of voices in the space are suggesting this could be a local bottom — and that when the rebound comes, Bitcoin could lead the charge back up.

What It Means for Traders on PRDT

Markets like these are where traders thrive — especially those using fast-paced platforms like PRDT.Finance. High volatility opens the door for explosive moves, both up and down, and savvy predictors can capitalize on short-term momentum.

Whether you’re watching for bounces off support, breakdowns below key levels, or simply trading the chaos — this is the kind of week where prediction markets shine.