Bitcoin has pushed past $109,000, inching closer to its all-time high. Yet despite the rally, data shows that many professional traders are approaching this price action with caution. Futures and options markets suggest uncertainty, not euphoria.

These shifts in sentiment and momentum are exactly the kind of conditions that attract attention on platforms like PRDT — where market volatility isn’t just observed, it’s acted on.

Key Market Insights

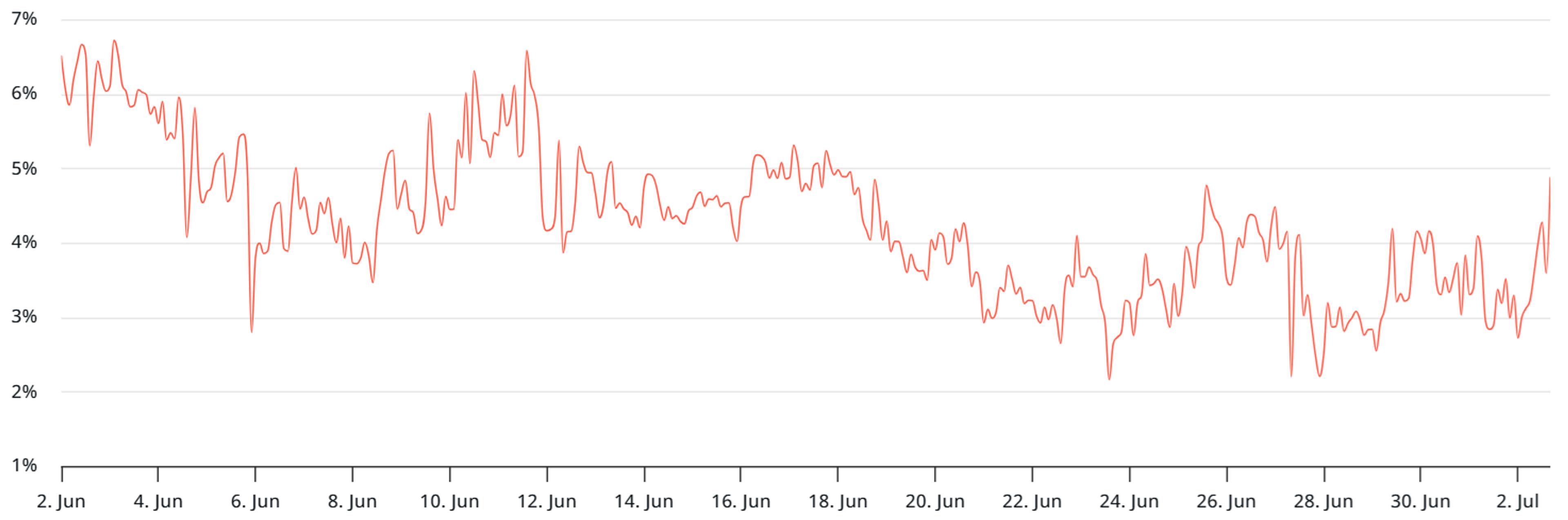

Despite trading just 2% below its all-time high, Bitcoin's futures market tells a different story. The 1-month BTC futures premium is still under the 5% neutral threshold — signaling a lack of conviction among institutional players.

This kind of hesitation often precedes sharp market moves in either direction.

BTC 1-month futures annualized premium.

Macro Factors Driving Momentum

Several broader economic signals may be contributing to this rally:

- Eurozone money supply (M2) expanded by 2.7% year-over-year in April — it's highest on record — pointing to ongoing inflationary pressures.

- U.S. labor data disappointed, with a 33,000 drop in private payrolls reported for June.

- Trade tensions continue to rise, with new tariff threats between the U.S. and Japan, and the EU taking a more aggressive stance on negotiations.

These global developments are fueling market volatility, which often leads to sudden price shifts — exactly the kind of environment where predictive insights can shine.

Neutral Sentiment, Hidden Opportunity

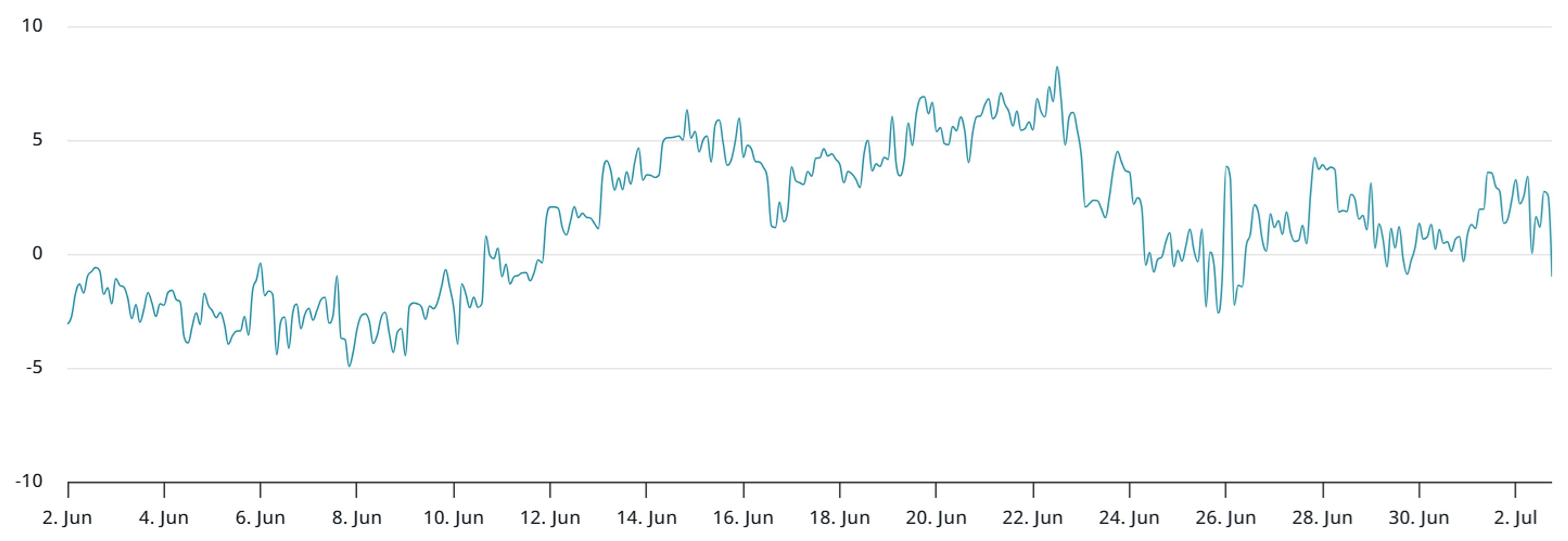

Options market data reflects a neutral outlook, with the 25% delta skew holding at 0%. Traders are not heavily positioned in either direction, suggesting that many are waiting for a stronger signal.

Traders show no clear directional bias, with delta skew hovering near zero.

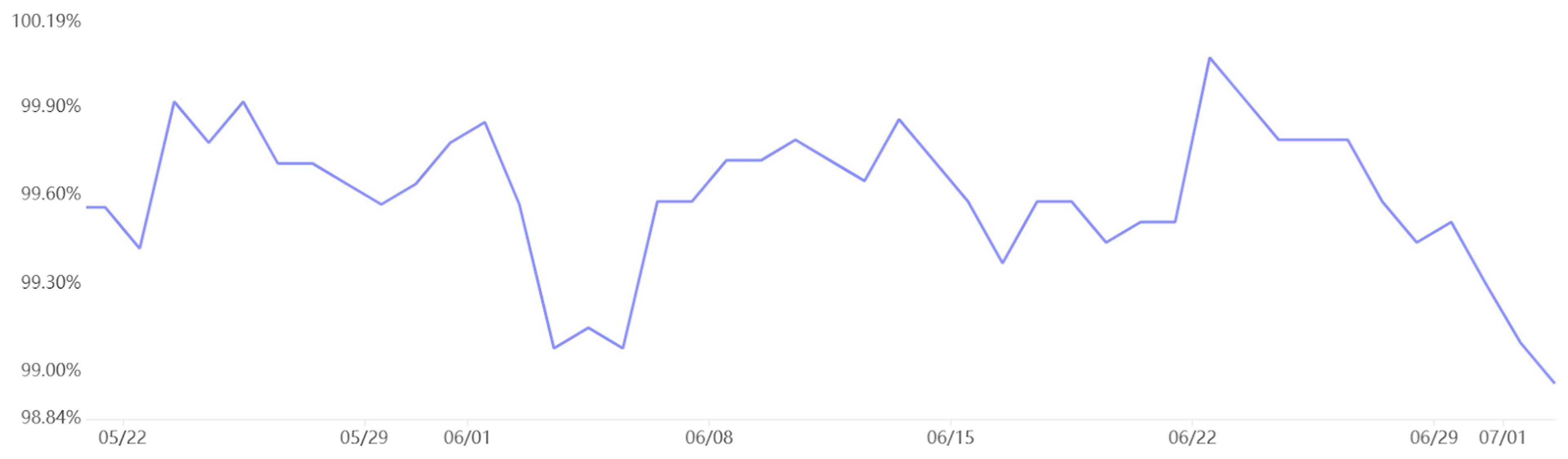

Meanwhile, in China, Tether (USDT) is trading at a 1% discount to the dollar — its steepest since mid-May. This often signals fear and capital outflows from crypto markets, despite Bitcoin's recent strength.

USDT trades at a discount relative to the Chinese yuan, indicating lower crypto demand in the region.

A Market at a Turning Point

Between macro uncertainty, cautious sentiment, and technical proximity to all-time highs, Bitcoin is approaching a pivotal moment. Whether the next move is a breakout or a pullback, it’s clear the market is looking for direction.

PRDT provides a way for traders to act on these insights in real time. Short timeframes and dynamic market rounds allow participants to put their views to the test — quickly, efficiently, and with minimal friction.

If you're tracking Bitcoin’s next move, this is a moment worth watching closely.