Bitcoin’s push to stay above the $90,000 threshold is losing steam, as U.S. tariff uncertainties and a pullback from institutional investors via exchange-traded funds (ETFs) hinder its recovery. Analysts attribute the faltering momentum to macroeconomic headwinds, spotlighting President Trump’s trade policies as a major spook for the crypto market.

Bitcoin (BTC), currently hovering at $90,130, enjoyed a brief rally, climbing nearly 10% to surpass $95,000 on March 2, 2025. However, the surge fizzled as it etched a double-top pattern near $94,200 on the daily chart—a technical formation often signaling an impending decline. Sure enough, BTC tumbled to $81,400 the following day and has since struggled to reclaim the $90K mark, according to TradingView data.

ETFs Amplify the Slump

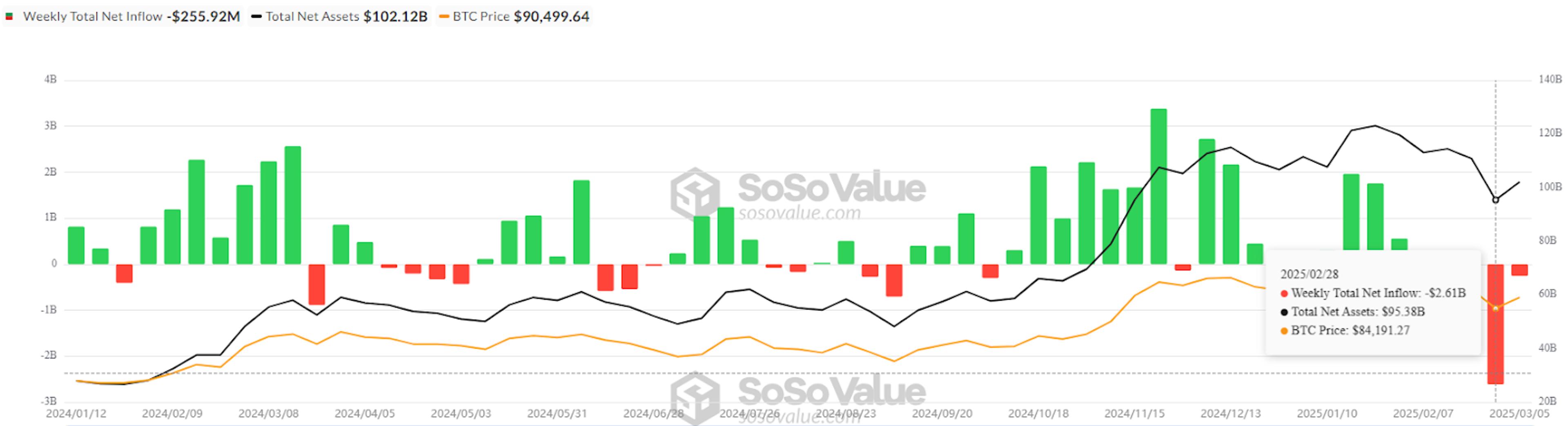

A significant drag on Bitcoin’s price comes from U.S. spot Bitcoin ETFs, which are facing a rough patch. Ryan Lee, chief analyst at Bitget Research, told reporters, “Heavy outflows from spot Bitcoin ETFs have intensified selling pressure, with institutional investors stepping back, likely rattled by macroeconomic uncertainties and a shift in risk tolerance.” Sosovalue data underscores the trend, showing cumulative net outflows exceeding $2.6 billion in the last week of February alone—the fourth consecutive week of negative flows for these funds.

Bitcoin ETF net flows, weekly chart. Source: Sosovalue

Tariff Threats Stir Market Jitters

Beyond the ETF woes, broader economic factors are weighing on Bitcoin. Lee pointed to “recent tariff announcements from President Trump” as a key driver, noting that they’ve “sparked worries about inflation and economic turbulence, pushing investors toward safer assets over riskier bets like Bitcoin.” The prospect of a global trade shake-up has left markets on edge, amplifying the crypto’s struggles.

Yet, there’s a sliver of optimism. Iliya Kalchev, a dispatch analyst at Nexo, suggested that next week could bring relief. “The rollout of U.S. tariffs has dragged down both crypto and traditional equities,” he said, “but comments from U.S. Commerce Secretary Howard Lutnick hint at a possible deal to ease tariffs on Canada and Mexico, potentially as early as Wednesday.” Such a move could temper fears of a trade war and bolster market sentiment.

Long-Term Hope Amid Short-Term Haze

Despite the current gloom, analysts are keeping their eyes on a brighter horizon. Bitcoin price forecasts for late 2025 range from $160,000 to $180,000, buoyed by rising on-chain activity that some interpret as a sign of a market bottom. Still, Kalchev cautioned that “trade policy uncertainty will likely keep investors wary in the near term,” though he added that “growing odds of Federal Reserve rate cuts could pave the way for a crypto turnaround.”

Meanwhile, the broader crypto market remains shaken by the $1.4 billion Bybit hack on February 21—the largest in its history—adding another layer of unease to an already volatile landscape.

What’s Next for BTC?

Bitcoin’s fight to hold $90K is a microcosm of wider market tensions. Tariff resolutions or Fed policy shifts could offer a lifeline, but for now, the crypto king faces an uphill battle. Will it stabilize, or is a deeper dip to $72K—as some fear—on the cards? The coming days may hold the answer.