Amid surging speculation and institutional maneuvers, traders across the crypto landscape are bracing for what could be the next major altcoin breakout — and it might just start with XRP.

XRP ETF Approval Odds Hit 85%

Momentum is building around the possibility of a spot XRP ETF. Bloomberg analysts have now pegged the odds of approval in 2025 at 85%, up from 65% just two months ago. This optimism follows leadership changes at the U.S. SEC and increased institutional interest.

Polymarket also shows rising confidence, with betting odds hitting 80% as of late April. This shift in sentiment has traders forecasting new all-time highs for XRP in the coming months.

While XRP currently trades around $2.20 — down 5% on the day following weak U.S. GDP data — technical analysts remain bullish. The token is forming a falling wedge pattern, historically a bullish signal. A breakout above $2.40 could trigger a surge to $3.74, with long-term projections reaching as high as $19.27.

XRP/USD daily chart. Source: Tradingview

Polymarket also shows rising confidence, with betting odds hitting 80% as of late April. This shift in sentiment has traders forecasting new all-time highs for XRP in the coming months.

Solana Derivatives Surge as ETF Speculation Grows

Solana is also showing signs of life. Futures open interest recently hit $5.75 billion, with traders speculating on a potential rally above $200.

Despite a short-term price dip below $150, Solana has held key support levels and continues to dominate decentralized exchange activity. With a spot Solana ETF decision expected by October 10 and approval odds reaching 90%, analysts believe a pre-ETF rally is on the table.

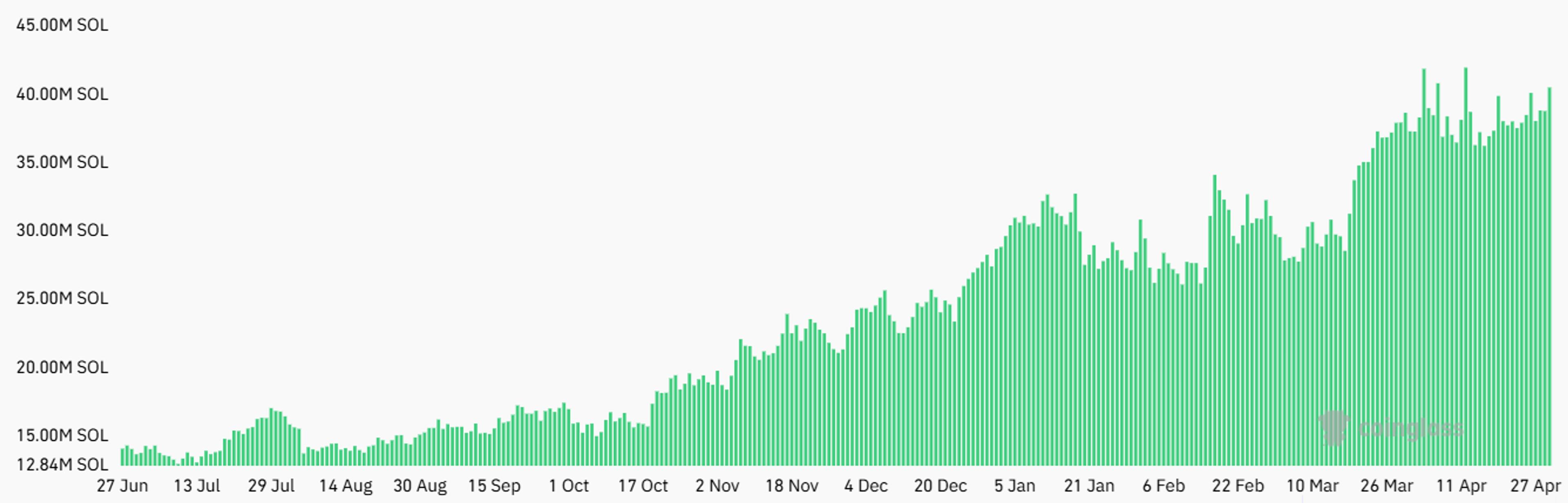

Solana’s DEX volumes outpaced Ethereum’s L2 ecosystem in the past week, highlighting growing user adoption beyond memecoin hype.

Solana futures aggregate open interest, SOL. Source: CoinGlass

Bitcoin Holds Steady as Traders Eye Rate Cuts

Bitcoin, too, is proving resilient. After dipping to $92,910 on weak U.S. GDP news, BTC quickly rebounded toward $95,000, mirroring recoveries in the S&P 500 and Dow Jones.

Traders appear unfazed by economic headwinds. Many expect the Federal Reserve to resume rate cuts in the near future — a move that historically boosts BTC’s price. Fed rate cut odds for June have jumped from 59.8% to 63.8% in just one day.

What This Means for Traders

The convergence of ETF optimism, strong on-chain data, and macroeconomic factors has reignited momentum in key crypto markets. XRP and SOL are riding waves of institutional anticipation, while Bitcoin remains a macro hedge amid economic uncertainty.

For traders looking to capitalize on volatility, the timing couldn’t be better. Whether it’s technical breakouts, ETF catalysts, or rate-driven rebounds — the setup for rapid market movement is here.

Platforms like PRDT.Finance allow traders to engage directly with these trends through real-time predictions on both crypto and forex. As the market heats up, fast decision-making and access to cross-asset exposure are proving more valuable than ever.

Ready to take the pulse of the market and act on it? Explore PRDT.Finance →